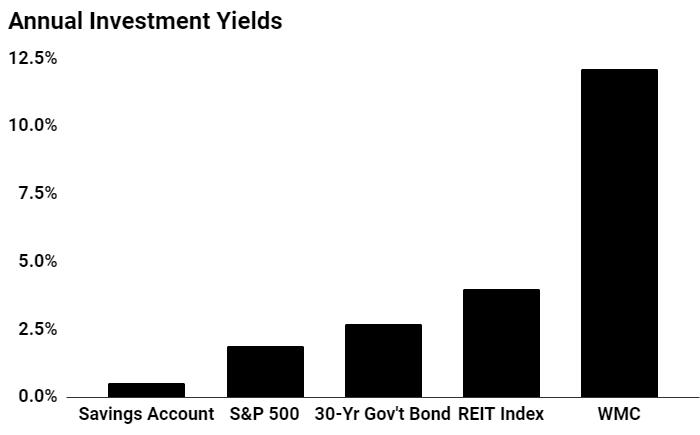

This Dividend Stock Yields 12.1%

Today’s chart highlights my favorite place to find safe seven percent, nine percent, and even 12% yields: mortgage real estate investment trusts (REITs).

Mortgage REITs work like a virtual bank. They borrow money from savers and lend out funds to homeowners. Because “Uncle Sam” backs many of these loans, investors prize these businesses for their safe income.

Case in point: Western Asset Mortgage Capital Corp (NYSE:WMC). This lender invests in residential mortgages with guarantees from federal agencies. And with a payout topping 12%, the stock is worth a second look.

Western is a sleepy business, for starters. The mortgage represents the last bill that people skip during a financial crisis. In the unlikely event of a default, the company stands first in line to get paid.

Furthermore, most of these loans have the backing of Uncle Sam. To encourage lending, federal agencies like Fannie Mae and Freddie Mac have ensured residential mortgages. This meant that even during the height of the 2008 financial crisis, insured mortgage-holders still got paid.

Western is also lucrative, with homeowners having to pay all of the closing costs and insurance premiums. And because Western has no physical branches, the trust has little in the way of overhead.

As a result, this firm gushes profits. Last year, Western generated $0.08 in return on every dollar of equity invested into the business. That number won’t get the Bitcoin bulls out of bed, but it’s impressive when you consider the safety of these loans. (Source: “Western Asset Mortgage Capital Corporation Announces Fourth Quarter And Full Year 2016 Results,” Western Asset Mortgage Capital Corporation, March 6, 2017.)

For owners, this translates into a tidy income stream. Western just sits back and goes about handing out their payments each month. They can predict to almost the dollar how much they’ll get paid for years to come.

Most of this income gets passed on to owners. Because of how management structured this business, they must pay out all of their profits to investors. Today, Western sends out a quarterly distribution of $0.31 per unit, which comes out to an annual yield of 12.1%.

(Data source: “Western Asset Mortgage Capital Corp,” Google Finance, last accessed July 17, 2017.)

Of course, no one is calling this stock a sure thing. Western’s profits depend on the difference between short- and long-term interest rates, called the “spread.” A bump in interest rates would clip profits. And because executives pay out all of the income in distributions, they don’t have a lot of wiggle room if business sours.

That said, management has does a great job hedging these risks. This business continues to generate ample cash flow each and every month. For investors looking to lock in a big yield, WMC stock is one to investigate further.