11%-Yielding Alliance Resource Stock Hits Record High

Outlook for ARLP Stock Robust on Favorable Regulatory Environment

President Donald Trump’s wavering approach to tariffs against Canada and Mexico and fears of a recession have been wreaking havoc on the stock market. Having said that, there are a few areas in which the president is unwavering.

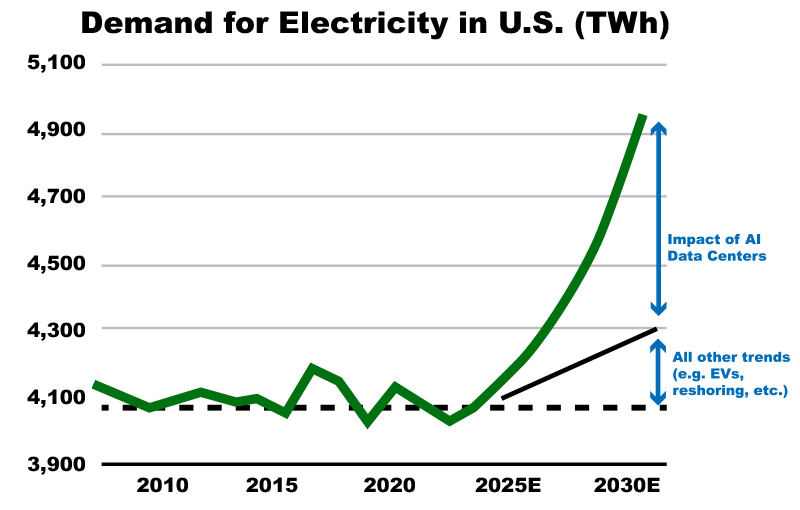

One of those is his commitment to use coal to help surging demand for electricity from manufacturing and to help juice the massive data centers needed to power artificial intelligence (AI).

At the January 2025 World Economic Forum in Davos, Switzerland, President Trump said that “Nothing can destroy coal. Not the weather, not a bomb – nothing. And we have more coal than anybody.” (Source: “Remarks By President Trump At The World Economic Forum,” The White House, January 23, 2025.)

Those are the kinds of comments that have helped energize Alliance Resource Partners, L.P. (NASDAQ:ARLP) stock to hit record levels.

Thermal coal might be dirty, but it’s actually essential for the green economy. Also going by the name “steam coal,” it is used to generate both electricity and heat. Thermal coal might be a major contributor to greenhouse gas emissions, but it’s also responsible for supplying roughly 35% of the world’s primary energy and 37% of its electricity. (Source: “Coal,” International Energy Agency, last accessed March 17, 2025.)

The outlook for thermal coal remains pretty solid, too. We can thank demand from electric vehicles (EVs), data centers, and especially the AI revolution for that.

Data Source: Alliance Resource Partners, L.P.

About Alliance Resource Partners, L.P.

Alliance Resource Partners is one of the largest coal producers in the eastern U.S., operating seven underground mining complexes serving major domestic and international electric power generation markets. (Source: “Investor Presentation, March 2025,” Alliance Resource Partners, L.P., last accessed March 17, 2025.)

Over 78% of the company’s 2025 sales-tonnage is contracted, while roughly 44% of its 2026 sales-tonnage is already contracted.

Alliance Resource is also a diversified natural resource company that owns a growing portfolio of mineral and royalty interests in strategic oil-and-gas-producing regions across the U.S.

It markets its oil and gas mineral interests for lease to major operators in those regions and generates royalty income from the leasing and development of those mineral interests. The limited partnership also generates coal royalty income from mineral reserves and resources it owns and leases to its coal mining operations.

Strong 2024 Results

Thanks to the continued strength of its coal contracts, Alliance Resource’s average coal sales price per ton for 2024 of $63.38 came close to the record level of $64.17 achieved in the 2023. (Source: “Alliance Resource Partners, L.P. Reports Fourth Quarter Financial and Operating Results; Declares Quarterly Cash Distribution of $0.70 Per Unit; and Provides 2025 Guidance,” Alliance Resource Partners, L.P., February 3, 2025.)

But lower sales volumes, higher operating costs, and several non-cash accruals caused the limited partnership’s 2024 financial results to fall short of last year’s record revenues and net income.

While not every year can be a record, 2024 results were still pretty solid.

Fourth-quarter revenue slipped 5.6% on an annual basis to $590.1 million. Net income was $16.3 million, or $0.12 per unit, down from $115.4 million, or $0.88 per basic and diluted limited partner unit, in the same prior-year period.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $124.0 million, compared to $185.4 million in the fourth quarter of 2024.

For full-year 2024, total revenue was down 4.6% at $2.45 billion. Net income was $360.9 million, or $2.77 per unit, compared to $630.1 million, or $4.81 per basic and diluted limited partner unit, in 2023. Adjusted EBITDA were $714.2 million, compared to $933.1 million in 2023.

Commenting on the fourth-quarter and full-year 2024 results, Joseph W. Craft III, Alliance’s chairman, president, and chief executive officer, said, “The cold winter weather at the start of this year has driven higher natural gas prices and increased coal consumption in the eastern United States, helping reduce inventories.”

Adding, “We are seeing customer solicitations for both near-term and long-term supply contracts, and if the colder weather continues to be above normal, we are hopeful we can reach our goal to ship 30 million tons to the domestic market in 2025.”

Craft noted that the partnership had largely completed major infrastructure projects at Tunnel Ridge, Hamilton, Warrior, and River View in 2024, so he expects to see improved costs and productivity along with reduced capital spending this year.

On top of that, the combination of cold winter weather and new liquefied natural gas (LNG) export terminal capacity should support strong domestic natural gas prices in 2025, benefiting both Alliance Resource’s coal and royalties segments.

Alliance Resource: 2025 Outlook

Looking ahead, Craft said, “For 2025, we expect improved coal production costs to counterbalance lower market prices, keeping Coal segment margins near 2024 Full Year levels.”

“In the Oil & Gas Royalty business, we achieved record production volumes for the 2024 Full Year despite only making modest additions to our overall acreage position. We continue to favor the cash flow generation profile and ability to self-fund growth in the Oil & Gas Royalties segment, and therefore, will actively pursue growth in this segment in 2025.”

Quarterly Distribution Maintained at $0.70/Unit

Much like a real estate investment trust (REIT), a limited partnership has to pay at least 90% of its income to shareholders in the form of a dividend.

Now, thanks to Alliance Resource’s conservative balance sheet and reliable distributable cash flow generation, it is able to provide its shareholders with a reliable distribution. Since its inception in 1999, the partnership has paid cumulative cash distributions of around $4.4 billion.

This past January, Alliance Resource’s board declared a quarterly cash distribution of $0.70 per unit, or $2.80 per share, for a current yield of 11.11%. (Source: “Alliance Resource Partners, L.P. Declares Quarterly Distribution of $0.70 Per Unit,” Alliance Resource Partners, L.P., January 28, 2025.)

ARLP Units Hit Record High on Trump Comments

Strong market penetration and a positive regulatory environment under President Trump have helped ARLP units hit a new record high. On January 23, Trump addressed the World Economic Forum in Davos, Switzerland. That same day, ARLP units hit a new record high of $29.80.

ARLP units have given up some short-term ground to profit-taking and concerns about how tariffs will hurt the broader economy, but they are still up 41% on an annual basis at $24.91 per share.

By all accounts, ARLP units are expected to hit new highs over the coming quarters, with Wall Street analysts providing a 12-month share price target range of $29.00 to $32.00. This points to potential gains in the range of 16.5% to 28.5%.

Chart courtesy of StockCharts.com

The Lowdown on Alliance Resource Partners, L.P.

Alliance Resource Partners is a thermal coal giant that continues to deliver strong operating and financial results. This includes record results in 2022 and 2023 and strong results in 2024.

The limited partnership’s outlook for 2025 remains robust and beyond. This is due in large part to a more favorable regulatory environment and an increase in forecasted electricity demand, particularly from data centers and AI.

That’s good news for the 173 institutions that hold 19.28% of all outstanding ARLP shares. Some of the stock’s largest institutional holders include Magnolia Group, LLC, Jackson Hole Capital Partners, LLC, Bank of America, and JPMorgan Chase & Co. (Source: “Alliance Resource Partners, L.P. (ARLP),” Yahoo! Finance, last accessed March 17, 2025.)

An even larger 29.32% of all outstanding shares is held by insiders. That kind of big position should encourage insiders to see Alliance Resource units continued to do well.