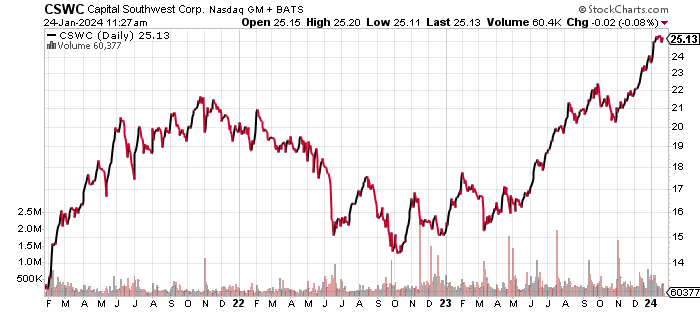

10%-Yield Capital Southwest Stock Up 33.5% in 1 Year

CSWC Stock Is a Consistent Dividend Payer for Income Seekers

It’s always nice to find a dividend stock that has a long history of paying regular distributions and, on occasion, delivering strong share-price appreciation. One of them that’s worth watching is Capital Southwest Corporation (NASDAQ:CSWC).

Capital Southwest stock has paid dividends for 41 consecutive years and has rewarded investors with a 33.46% share-price gain over the last year (as of this writing). This combination of price appreciation and regular dividends is the ultimate goal for income investors when looking for stocks.

Capital Southwest is a business development corporation (BDC) that undertakes credit, private equity, and venture capital investments in middle-market companies. (Source: “Capital Southwest Corporation (CSWC),” Yahoo! Finance, last accessed January 24, 2024.)

It makes mezzanine, later-stage, mature, late-venture, emerging-growth, buyout, recapitalization, and growth-capital investments.

Capital Southwest Corporation’s targeted areas of investment include industrial manufacturing and services, value-added distribution, health-care products and services, business services, specialty chemicals, food and beverage, tech-enabled services, and software as a service (SaaS).

Capital Southwest held about $1.4 billion in investments at fair value at the end of September 2023. (Source: “Capital Southwest Increases Credit Facility to $460 million,” Capital Southwest Corporation, December 11, 2023.)

In a move to increase its available capital for investments, the BDC recently raised its senior secured credit facility from $435.0 to $460.0 million.

CSWC stock paid quarterly dividends of $0.63 per share in December 2023, compared to $0.57 per share in December 2022. (Source: “CSWC Dividend History,” Nasdaq, last accessed January 24, 2024.)

As of this writing, this represents a forward yield of 10.02%.

Capital Southwest stock’s share price reached a 52-week high of $25.51 on January 18, 2024, which was only a few dollars off from its record high of $28.41 in October 2021.

Chart courtesy of StockCharts.com

Capital Southwest Corporation Reports Growing Revenues & Free Cash Flow

Capital Southwest reports in a fiscal year ending March 31.

The BDC’s five-year revenue picture shows growth in three of its last four reported fiscal years, with the high point being fiscal 2020. Its five-year second-best revenues were $102.4 million in fiscal 2023.

Capital Southwest Corporation’s revenue outlook is positive. Analysts estimate that the company will report higher revenues of $174.9 million for fiscal 2024, followed by $199.5 million for fiscal 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $72.7 | N/A |

| 2020 | $104.3 | 43.4% |

| 2021 | $59.5 | -42.9% |

| 2022 | $89.5 | 50.3% |

| 2023 | $102.4 | 14.4% |

(Source: “Capital Southwest Corp.” MarketWatch, last accessed January 24, 2024.)

Capital Southwest has largely generated generally accepted accounting principles (GAAP) profits. There has, however, been some inconsistency in terms of its GAAP-diluted earnings per share (EPS). That’s expected, given Capital Southwest Corporation’s type of business, which depends on the success of the companies in which it invests..

This is likely the reason for the inconsistent dividend growth. But what CSWC stockholders get in return are consistent payments and the potential for decent share-price appreciation.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.98 | N/A |

| 2020 | -$1.24 | -162.9% |

| 2021 | $2.67 | 315.0% |

| 2022 | $1.87 | -29.8% |

| 2023 | $1.10 | -41.2% |

(Source: MarketWatch, op. cit.)

Capital Southwest Corporation’s funds statement shows the BDC producing consistent free cash flow (FCF) over its last five reported fiscal years. This includes three straight years of FCF growth to a five-year high in fiscal 2023.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $26.3 | N/A |

| 2020 | $24.9 | -5.3% |

| 2021 | $35.7 | 43.1% |

| 2022 | $43.5 | 22.0% |

| 2023 | $64.1 | 47.3% |

(Source: MarketWatch, op. cit.)

Capital Southwest’s working capital is extremely strong, but the risk with this company is the debt of $735.4 million on its balance sheet. (Source: Yahoo! Finance, op. cit.)

The Lowdown on Capital Southwest Stock

I view Capital Southwest Corporation as a great way to generate consistent dividend income, with the added potential for capital appreciation.

Note that CSWC stock’s forward yield of 10.02% is just above its five-year average dividend yield of 8.94%. (Source: Yahoo! Finance, op. cit.)

The risk is that there will be some volatility, considering the nature of the company’s business. But in exchange for dealing with that volatility, Capital Southwest stockholders get regular dividend income.